In construction and property management, managing cash flow is as critical as managing projects. Yet, many firms still rely on outdated payment processes, often juggling multiple bank portals, manual reconciliations, and fragmented data. Banking automation and ERP integration can change cash management from a time-consuming chore into a strategic advantage.

The Shift from Checks to Digital Payments

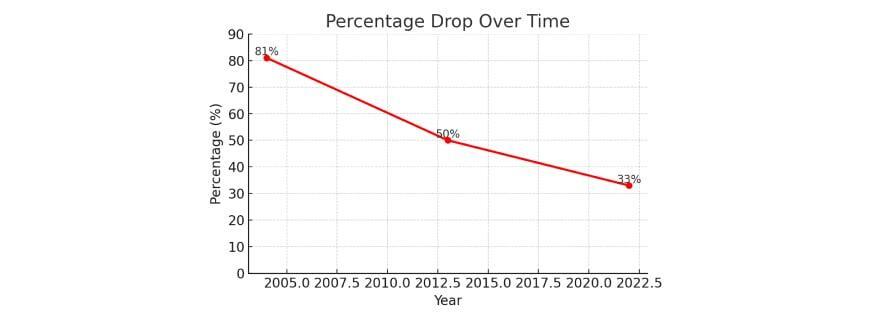

Paper checks once dominated B2B transactions—over 80% in 2004 in the U.S. and Canada. By 2022, that number had dropped to around 33%, replaced by ACH/EFT transfers, pre-authorized debits, and real-time payments.

Why the decline?

- Cost: $2–$4 per check vs. ~$0.30 for ACH/EFT

- Speed: Days or weeks for checks vs. same-day/next-day electronic

- Security: Checks are still the #1 fraud-prone payment method

| Payment Method | Typical Use | Key Benefits | Limitations |

|---|---|---|---|

| ACH / EFT | Vendor payments, payroll, owner distributions | Low cost, secure, faster than checks | Limited remittance unless using advanced formats |

| Pre-Authorized Debits (PAP) | Utilities, taxes, recurring charges | No missed payments, low admin effort | Requires robust reconciliation |

| Online Bill Pay | Utilities, taxes, telecoms | No need for vendor bank info | Still semi-manual without ERP integration |

| Real-Time Payments | Urgent vendor/contractor pay | Instant settlement, rich data | Adoption still growing |

The ERP Integration Advantage

Even with modern payment rails, many firms process payments outside their ERP, then reconcile manually. This creates:

- Delays in matching payments to properties or projects

- Duplicate data entry

- Limited cash visibility

Integrating commercial banking directly with ERP solves these pain points by:

- Automating Payment Initiation – Payments flow from approved invoices in ERP directly to the bank, without re-keying data.

- Streamlining Reconciliation – Bank transaction feeds auto-match to ERP records, often achieving 75%+ straight-through reconciliation rates.

- Enhancing Cash Visibility – Real-time bank balances and payment statuses appear inside ERP dashboards.

Why Middleware Like KriyaCash Makes It Work

Direct ERP–bank integrations can be complex, especially across multiple banks and formats (NACHA, CPA-005, ISO 20022). KriyaCash acts as a financial control center between your ERP (MRI, Yardi, CMiC, etc.) and your banks, providing:

- Multi-Bank Connectivity – Integrations with Wells Fargo, TD, Scotiabank, and others

- Multi-Method Payments – ACH/EFT, wires, real-time payments, virtual cards, and even automated check outsourcing when needed

- Property-Centric Workflows – Every transaction tagged at the property/project level

- Automated Reconciliation – BAI2/CAMT file parsing, AI matching, virtual account support

- Credit Card Feed Matching – Automatic allocation of corporate card charges to the correct GL codes

Figure 2 – How KriyaCash Fits into Your Financial Ecosystem

(A diagram showing ERP ↔KriyaCash ↔ Banks, with arrows for payments, statements, and reconciliations)

Benefits & ROI

| Benefit | Legacy Manual | With ERP + Bank Integration |

|---|---|---|

| Payment Processing Cost | $2–$4 per check | ~$0.30 per ACH/EFT |

| Reconciliation Time | Weeks post-month-end | Often same day |

| Error Rate | High (manual entry, duplicates) | 75% fewer reconciliation errors |

| Cash Visibility | Fragmented across portals | Real-time, consolidated view |

| Fraud Risk | High (check interception) | Lower (bank security + workflow controls) |

Industry benchmarks show AP automation can cut total processing costs by up to 80% and achieve ROI in 6–12 months.

The Future Is Connected

For CFOs, this is about better financial control. For CTOs, it’s about system efficiency and security. For operating teams, it’s less manual work and more accurate data.

Banking automation isn’t just about faster payments—it’s about integrating your financial ecosystem so you can manage cash in real time, across properties, with complete confidence in your numbers.